Hi,

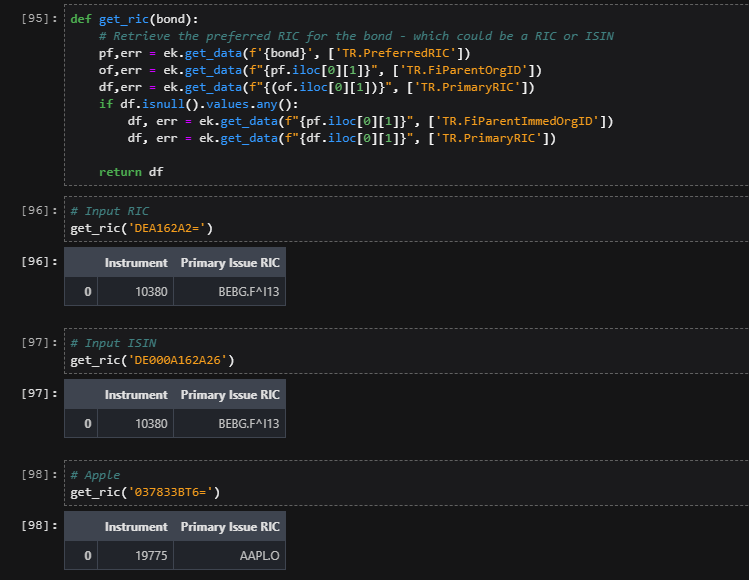

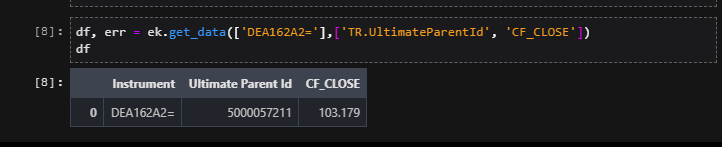

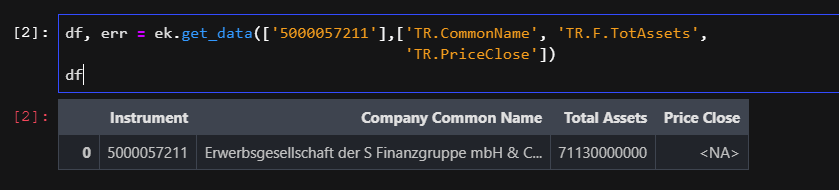

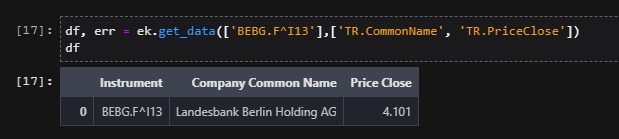

I am using the python interface to the API to retrieve corporate bond data, I have a list of their RICs. Now, I need data about close prices of their issuers equity. The question is: is there a best practice for that? For instance, for the RIC "DEA162A2=" the ultimate parent id is not listed, while the immediate parent it is. But in general? Any solution?

Thanks a lot

Emanuele