Hi,

I am working to retrieve historical delta of specific dates of one specific option. However, I didn't find the date parameter for the delta codes. May I ask is there any way to retrieve the deltas?

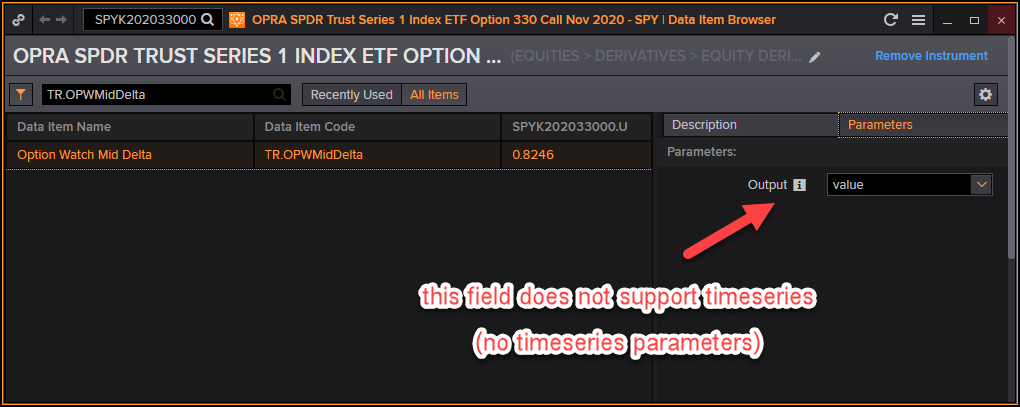

For example, for option "SPYK202033000.U", I can use 'TR.OPWMidDelta' to retrieve today's delta. But how to retrieve previous days' deltas?

Thanks!